Operations in 2016

Net sales

SEK 67,561m

Adjusted operating profit1)

SEK 8,155m

Adjusted operating margin1)

12.1%

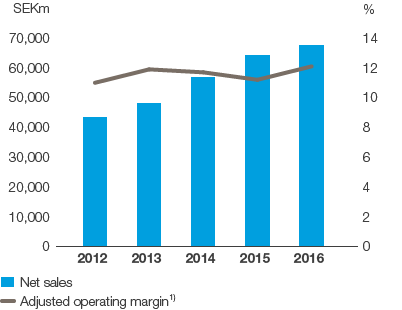

Net sales increased by 5% to SEK 67,561m (64,184). Organic sales, which exclude exchange rate effects, acquisitions and divestments, increased by 3%, of which price/mix accounted for 1% and volume for 2%. The acquisition of Wausau Paper Corp. increased net sales by 5%. Organic sales decreased by 1% in mature markets and increased by 10% in emerging markets. Emerging markets accounted for 32% of net sales. Exchange rate effects decreased net sales by 3%.

For consumer tissue, organic sales increased by 3%. Growth is related to high growth in emerging markets, particularly China, Latin America and Russia. For AfH tissue, organic sales increased by 3%. The increase was related to Western Europe and emerging markets.

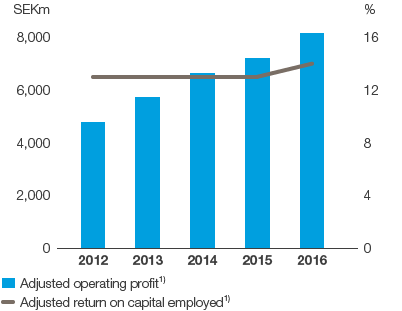

The adjusted operating profit1) rose 13% (12% excluding currency translation effects and acquisitions) to SEK 8,155m (7,217). A better price/mix, higher volumes, cost savings, lower raw material and energy costs, and acquisitions contributed to the earnings increase. The acquisition of Wausau Paper Corp. increased operating profit by 4%. Selling costs were higher, and investments were made in increased marketing activities. The British pound and Mexican peso have weakened against several trading currencies, which had a negative earnings effect.

The adjusted operating margin1) amounted to 12.1% (11.2).

The adjusted return on capital employed1) was 13.5% (12.9).

The operating cash surplus amounted to SEK 11,970m (10,703). Operating cash flow amounted to SEK 9,334m (7,667).

Capital expenditures amounted to SEK 4,101m (3,536).

Targets

- Annual organic sales growth of 3–4%

- Return on capital employed of 15% over a business cycle

Outcome 2016

Organic sales

+3%

Adjusted return on capital employed1)

13.5%

1) Excluding items affecting comparability.

Net sales by product segment

SCA’s sales to retailers’ brands as a proportion of total consumer tissue sales was 36%.

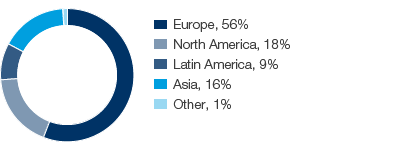

Net sales by region

|

SEKm |

2016 |

2015 |

||

|

||||

|

Net sales |

67,561 |

64,184 |

||

|

Operating cash surplus |

11,970 |

10,703 |

||

|

Change in working capital |

861 |

–285 |

||

|

Current capital expenditures, net |

–3,159 |

–2,260 |

||

|

Other operating cash flow |

–338 |

–491 |

||

|

Operating cash flow |

9,334 |

7,667 |

||

|

Adjusted operating profit 1) |

8,155 |

7,217 |

||

|

Adjusted operating margin, % 1) |

12.1 |

11.2 |

||

|

Capital employed |

61,335 |

55,053 |

||

|

Adjusted return on capital employed, % 1) |

13.5 |

12.9 |

||

|

Strategic capital expenditures |

|

|

||

|

plant and equipment |

–942 |

–1,276 |

||

|

company acquisitions/divestments |

–6,395 |

0 |

||

|

Average number of employees |

28,742 |

27,210 |

||

|

No. of employees at Dec. 31 |

29,192 |

27,024 |

||

Emerging markets accounted for

of the business area’s net sales in 2016. In emerging markets, organic sales increased by 10% in 2016.

Net sales and adjusted operating margin1)

1) Excluding items affecting comparability.

2012 and 2013 restated in accordance with IFRS 10 and 11.

Adjusted operating profit and adjusted return on capital employed1)

1) Excluding items affecting comparability.

2012 and 2013 restated in accordance with IFRS 10 and 11.