Financial targets and outcomes

ORGANIC SALES GROWTH1)

Group

OUTCOME 2016

+2 %

Personal Care

TARGET

5–7%

OUTCOME 2016

+3%

Tissue

TARGET

3–4%

OUTCOME 2016

+3%

Forest Products

TARGET

Grow in line with the market

OUTCOME 2016

–3%

TARGET

SCA’s target for annual organic sales growth for Personal Care is 5–7%, while the target for Tissue is 3–4%. For Forest Products, the target is to grow in line with the market.

In 2016, the Group’s organic sales increased by 2%. Organic sales increased by 3% for Personal Care and 3% for Tissue. Organic sales in Forest Products decreased by 3%.

1) Excluding exchange rate effects, acquisitions and divestments.

CAPITAL STRUCTURE

TARGET

SCA’s target is to have an effective capital structure, while at the same time ensuring long-term access to loan financing. Cash flow in relation to net debt is to be taken into consideration in the target to maintain a solid investment grade rating.

OUTCOME 2016

SCA had a solid investment grade rating

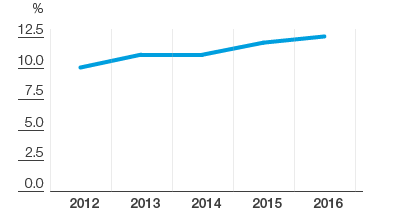

RETURN ON CAPITAL EMPLOYED

Group

TARGET

13%

OUTCOME 20161)

12.5%

Personal Care

TARGET

30%

OUTCOME 20161)

31.8%

Tissue

TARGET

15%

OUTCOME 20161)

13.5%

Forest Products

TARGET

Top quartile of the industry

OUTCOME 20161)

5.7%

TARGET

Adjusted return on capital employed1)

1) Excluding items affecting comparability.

The Group’s overall profitability target is to achieve a return on capital employed of 13% over a business cycle. The target is 30% for Personal Care, 15% for Tissue and to be in the top quartile of the industry for Forest Products.

In 2016, the Group’s adjusted return on capital employed1) was 12.5%. The adjusted return on capital employed1) was 31.8% for Personal Care and 13.5% for Tissue. The adjusted return on capital employed1) for Forest Products was 5.7%.

Back to SCA's strategy